BRIEF FROM THE CANADIAN FEDERATION OF AGRICULTURE

Executive Summary:

1. Recommendation #1: Maintain funding for all current Growing Forward Business Risk Management (BRM) programs for 2012 – Despite significant advances in technology, farming remains an unpredictable and risky business. For many farm families, government BRM and non BRM programs help reduce the impact of these risks and provide some predictability to farm income. CFA strongly recommends that BRM and non-BRM programs remain fully-funded in Budget 2012.

2. Recommendation #2: Remove tax barriers that prevent a smooth transfer of farms between generations – The CFA recommends that Budget 2012 address intergenerational transfer issues that are caused by the Non-arm's Length Sale of Shares [84.1(1)] and Deemed Proceeds or Capital Gain [55(2)] issues. These provisions add significant difficulties to intergenerational transfers within farm families, and desperately need to be adjusted or removed. In addition, the implementation of the T5013 reporting requirements recently amended by the Canadian Revenue Agency must be delayed, as they will cause significant reporting difficulty by the March 2012 deadline.

3. Recommendation #3: Encourage innovation and reduce regulatory burdens - The CFA recommends continue investment into Growing Forward non-BRM programs, especially those focused on innovation and research. Active research activity is key to the long-term health of the agriculture sector, and the CFA recommends significantly increasing the budget for research programs. The CFA recommends that the government remove the non-BRM clause currently written into the AgriFlexibility policy and work with industry to ensure the program has adequate resources to meet the needs of Canadian farmers. In addition, the increase in value of the Canadian dollar means we must compete much more aggressively in international markets, and reducing regulatory burdens is one way of enabling that. The CFA recommends continuing and expanding upon the work of the Red Tape commission in Budget 2012.

CFA Pre-Budget Submission

The Canadian Federation of Agriculture is an umbrella organization representing more than 200,000 farm families across Canada. These farm families operate small businesses and work hard to benefit all Canadians by contributing significantly to the Canadian economy, providing safe and affordable food and a clean, sustainable environment. The mandate of the CFA is to promote the interests of Canadian agriculture and agri-food producers, and to ensure the continued development of a viable and vibrant agriculture and agri-food industry in Canada.

In a general sense, the CFA believes federal decisions on taxes, fees and other charges should be based on two criteria. Number one should be to create a competitive business environment for Canadian entrepreneurs, while balancing the need for the federal government to invest in public goods in infrastructure, environment and health. Specifically, Canadian taxes, fees and other charges should be compared to our international competitors, compared to our business, education, health and regulatory environment within Canada, and set appropriately to achieve competitive advantage. Currently in Canada, significant opportunities abound when it comes to adjusting the taxation, regulatory and entrepreneurial environments Canadian businesses operate in. Second, these decisions should also balance the need for equitable, broadly-based policy but also include targeted initiatives for certain groups and business sectors. No sector or group is the same. Each has unique needs and requirements. Targeting can achieve greater precision and effective spending to achieve national objectives.

Competitive public policy within Canada relative to other countries creates competitive advantage for Canadian businesses. Agriculture can be a prime example of this where national investments into public goods such as transportation infrastructure, low inspection fees, smooth regulatory processes, and investment into environmental services have created more competitive agricultural producers in other nations.

An important issue, especially since the market upheavals of the past few years, is the availability of credit for agriculture producers. The CFA appreciates the role government has played in extending credit to farmers in need and liquidity is available within sectors in need, and we encourage the Standing Committee on Finance and the Federal Government to continue their efforts in this regard. While we certainly hope that the bulk of volatility and market challenges are behind us, we strongly encourage the government to engage the sector to monitor credit availability challenges to producers and the entire agri-food value chain. The loss of a valuable processor to artificial liquidity constraints can affect large groups of farmers, as can the restriction of operating credit for an important input supplier, food processor, or grain elevator.

Recommendation #1: Maintain funding for all current Growing Forward Business Risk Management (BRM) programs for 2012

Despite significant advances in technology, farming remains an unpredictable and risky business. For many farm families, government BRM programs help reduce the impact of these risks and provide some measure of stability to farm income. The current suite of Business Risk Management (BRM) programs was rolled out in 2008 as components of Growing Forward. The CFA strongly recommends that Budget 2012 maintain full funding for these demand-driven programs, especially AgriStability. While AgriStability is by no means perfect, is has become an important component of a farms’ risk management strategy, and any removal or reduction in coverage could be devastating to many farmers

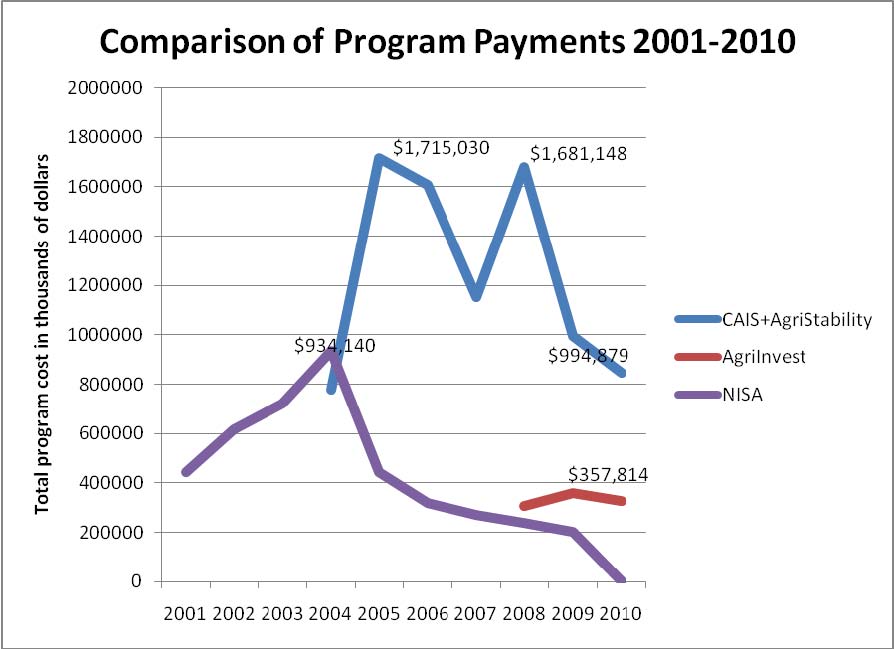

As can be seen in the following table, payments from AgriStability/CAIS and AgriInvest have fallen significantly over the past number of years. This can be explained by two significant events. First, returns from the grains and oilseeds sector, by far the largest group of participants in AgriStability, have increased dramatically. This has resulted in much lower demand on the program. Secondly, returns in the livestock sector remain historically low in comparison to their long-term average. Since reference margins for AgriStability are derived from historical farm revenue, this means that livestock farmers are no longer triggering payments from AgriStability. Combined, these two factors have led to a drop in total federal and provincial AgriStability payments of 50% ($-834 million) from 2008 due to reduced program demand. Overall, direct federal and provincial payments to farmers have dropped almost 30% in the past two years due to reduced demand. The investment made by the government into the Canadian agriculture sector is starting to pay significant dividends.

However, AgriStability is not perfect. The CFA strongly encourages government to augment the AgriStability program to better reflect identified issues and make it more reactive to the livestock sector. Specific changes should include:

· Remove negative margin viability test

· Provide farmers with the choice of having either the top 15% of the reference margin coverage or participation in the AgriInvest program

· Provide the highest reference margin by using in the calculation either a five-year Olympic or a previous three-year average reference period

· Increase negative margin coverage from 60% to 70%

These changes would convert AgriStability to a responsive program, with the capacity to deal with changing market circumstances. The program would finally meet the accepted criteria of being predictable and bankable. It is estimated these changes would provide a $330 million annual investment in farm businesses across Canada.

Recommendation #2: Remove tax barriers that prevent a smooth transfer of farms between generations

The CFA recommends that Budget 2012 address intergenerational transfer issues caused by the Non-arm's Length Sale of Shares [84.1(1)] and Deemed Proceeds or Capital Gain [55(2)] provisions in the Income Tax Act.

For Non-arm’s Length Sale of Shares [84.1(1)], the issue revolves around accessing the capital gains exemption when the transaction is with a family member (non-arms length transaction). In situations where a parent is attempting to sell the shares in a family owned small business corporation or family farm corporation, the full income tax benefits are effectively denied as a result of anti-avoidance rules in the Income Tax Act (subsection 84.1(1)).

In a sale of the shares of the company to a non related purchaser, a holding company is generally used as the purchasing vehicle. This allows the purchaser to access funding to facilitate the purchase of the acquired company. This structure works for the purchaser, as they access the acquired company's income stream and for the vendor, as they access their enhanced capital gain exemption on the sale.

However, when dealing with family (non-arms length), the benefits of this structure are effectively denied to the family. As previously mentioned, anti-avoidance rules deny the benefits in a family transaction under the previously mentioned anti-avoidance rules. As most family farms now operate as corporations the intergenerational family farm transfer rules are not necessarily achieving their intended objectives (i.e., facilitating the transfer of the family farm to the next generation and deferring the income tax on the transfer and, therefore, reducing the transaction price required by the parent for their retirement.)

With regards to Deemed Proceeds or Capital Gains, Section 55(2) adds significant barriers to splitting up a farm that is jointly owned by two siblings. For the purposes of Section 55, a brother and sister (or any two siblings) are considered to be unrelated. This could have implications for both intergenerational transfers and succession planning. Section 55(2) is undoubtedly the most complex provision in the entire Income Tax Act, and disproportionately impacts the farms responsible for the majority of production in Canada. This has become more urgent due to impending farmer retirements and the need to transition farm assets from one generation to the next. These provisions add significant difficulties to intergenerational transfers within farm families, and desperately need to be adjusted or removed.

In addition, the CFA has learned the implementation of the T5013 reporting requirements recently amended by the Canadian Revenue Agency is causing significant difficulties with farmers and their accountants. Previously, partnerships with fewer than six partners were exempted from the reporting requirements, but this was changed to include all farm partnerships. This amendment will place a huge burden on farmers and their accountants as it will require significant background paperwork for any sizable commercial farm. For the first year, especially, many accounting firms will have difficulty in meeting this new deadline because of the significant background work required. In addition, many farmers will never have their data in time for the March 31 deadline in subsequent years, and will be forced to pay late-filing penalties every year. While this is a CRA-specific regulatory change, farmers and their accountants would appreciate a statement in Budget 2012 that relaxes this reporting requirement for 2012 and possibly changes the permanent deadline from March 31 to June 31 in perpetuity.

Recommendation #3: Building the foundation for a globally-competitive sector

The CFA recommends continue investment into Growing Forward non-BRM programs, especially those focused on innovation and research. Active research activity is key to the long-term health of the agriculture sector. A commitment must be made to invest in agricultural research, restoring funding level for agricultural research to at least the mid-1990 levels as an essential component to a globally-competitive agricultural sector. Due to reduced demand on BRM programs, Agriculture and Agri-Food Canada (AAFC) has realized a 42% in their total funding demands--from $4.5 billion (average of 2004-2008) down to $2.57 billion for 2011-2012. If even a fraction of this savings was reinvested into agricultural research and innovation, Canadian agriculture would be well positioned for the next 20 years of growth. Budget 2012 can revitalize Canadian agricultural research and development (R&D) by:

· Dedicating significant funding to basic public research,

· Leveraging government funds to stimulation private or public/private projects and investment,

· Articulating a clear vision on what priorities should be set for research scientist succession planning and maintaining research stations across Canada,

· Sending a clear signal to our University researchers that agricultural research will be supported through programs like NSERC. One possible mechanism would be to set up Agriculture Sector R&D Initiatives similar to the 5 year, $34million program announced for the Forestry sector in 2009.

The CFA appreciates the leadership role played by the federal government in addressing strategically-important issues through their AgriFlexibility program. A number of provinces, regions, and commodities have put forward ideas falling within the mandate of this new federal funding envelope. The non-BRM programs listed above are vital to the long-term viability of the primary agriculture sector, and the CFA commends the government for providing additional support toward moving the sector into the future. However, issues can periodically arise within a specific commodity or sector where supporting affected farmers is not easily possible within existing programs. Often, the solution is a hastily developed ad hoc program through which money often flows too late to meet the need.

The CFA recommends that the government remove the non-BRM clause currently written into the AgriFlexibility policy and work with industry to ensure the program has adequate resources to meet the needs of Canadian farmers.

Finally, CFA recognizes the importance of initiatives like the Red Tape commission in dealing with regulatory issues. While the work of this commission is difficult and lengthy, the increase in value of the Canadian dollar means we must compete much more aggressively in international markets. Reducing regulatory burdens is one way of enabling that. The CFA recommends continuing and expanding upon the work of the Red Tape commission in Budget 2012.